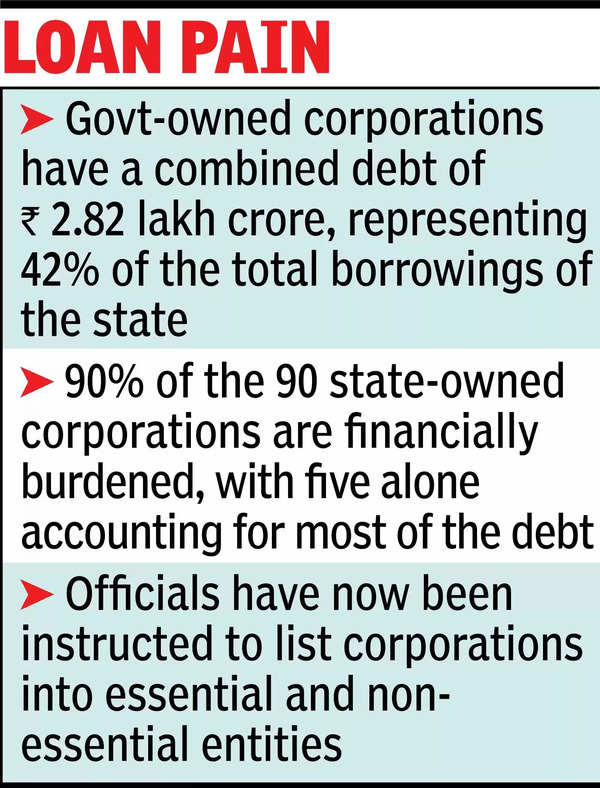

Hyderabad: The state government is considering merging or dismantling many debt-ridden state-owned enterprises as part of efforts to deal with the growing financial crisis. A detailed assessment revealed that these companies have accumulated a huge debt of Rs 282 crore, accounting for 42% of the country’s total borrowings.

In addition, 90% of the 90 state-owned enterprises face financial burdens, with only 5 of them accounting for the largest share of debt. As a result, the government is under pressure to resolve these debts even though it does not provide any guarantees for the borrowings.

State governments borrow through two mechanisms: budget borrowing (included in the budget estimate and raised through RBI securities) and off-budget borrowing (raised by state-owned enterprises with or without state guarantees).

Officials have now been instructed to classify companies into essential and non-essential entities.

State-owned enterprise carries debt of over Rs 2.80 lakh

One assessment shows that the debt of many state-owned enterprises has reached a staggering 2.82 billion rupees, accounting for 42% of the country’s total borrowings. As part of efforts to deal with the growing financial crisis, the Telangana government has directed officials to prepare a list to classify companies into critical and non-critical entities.

The government is considering closing companies that mismanage public resources, while those deemed essential will be restructured to ensure efficient delivery of services, with a focus on companies providing benefits to BC, SC and ST. In addition, the government intends to support businesses with the potential to generate revenue and operate efficiently.

Of the total debt incurred by companies in the past decade, Rs 1,272.08 billion was guaranteed by the state government, while Rs 95,462 crore was repaid from the companies’ own resources. In addition, companies independently borrowed Rs 59,414 crore, which is currently expected to be disbursed from the state exchequer due to insufficient revenue generation.

high interest rates

The loan interest rates for these enterprises exceed the current market interest rate by 7.63%, and some are as high as 10.49%. For example, Kaleshwaram Corporation owes Rs 74,599 crore with an interest rate of 9.69 per cent, while Telangana Drinking Water Corporation owes Rs 202 billion with an interest rate of 9.48 per cent. Other companies such as water resources companies have borrowed Rs 140.6 billion at an interest rate of 10.49%. Besides, the debt of housing companies and road development companies is Rs 9,000 crore and Rs 2,951 crore respectively.

Other specific allocations include Rs 4,000 crore raised by sheep companies for sheep development, Rs 600 crore for fisheries projects and Rs 3,535 crore for hospital construction by various companies. However, many of these entities are struggling to stay afloat due to a lack of funding.

Some are still self-sustaining

Although many state-owned enterprises are financially strapped, some are still self-sustaining. For example, Telangana Road Transport CorporationTourism Development Corporation, Beverage Corporation and other companies such as Genco, Transco, Civil Supplies Corporation and Singareni Collieries have managed to generate enough revenue to meet their operating expenses (including wages).

Some entities, such as film and television companies, theater development companies, Telangana Agros, etc., have ceased operations due to lack of funds, indicating growing concerns about misallocation of resources.

The Telangana government now faces the delicate task of balancing fiscal sustainability with the welfare of its citizens. A senior official said the restructuring plan is aimed at streamlining operations and ensuring efficient utilization of public funds for the benefit of the people of Telangana.

Stay up to date with the latest developments latest news exist times of india. Don’t miss the annual 2025 horoscope and Chinese horoscope 2025 for mouse, ox, tiger, rabbit, dragon, snake, horse, goat, monkey, Rooster, dogand pig Zodiac signs. Spread the love this holiday season with these new year wishes and message.