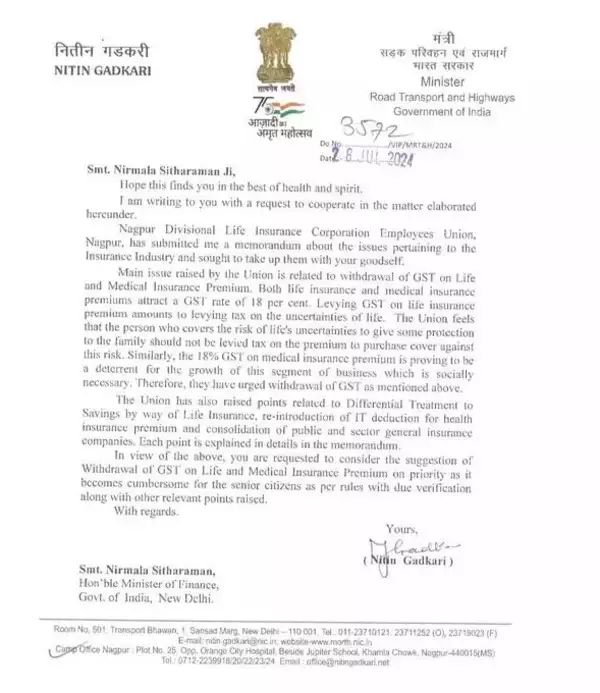

Union Minister Nitin Gadkari has written to Finance Minister Nirmala Sitharaman calling for the repeal of the present 18% Goods and Services Tax (GST) on life and health insurance premium.

The main thing the union had raised was about removal of GST on premiums for life and health insurances, he said in a letter to the foreign minister. Medical Insurance Premiums At 18%. Life Insurance Consumption tax on life insurance is same as tax on uncertainty of life.

According to him “the Union feels that one should not be taxed for buying an insurance against a risk which emanates from death and provides some cover for his family if this risk materializes. Besides, this can be seen as a form of consumption tax paid by society at large through its national government in order to secure its future which is highly expensive—18% GST on medical insurance premiums is no exception. Growth here will be hampered for these reasons and thus they are asking it be removed as stated earlier.”

However, according to the Union Road Transport and Highways Minister; among other things, the Union has proposed differential treatment of savings through life insurance policies. They have also called for restoration of income tax exemption with respect to individual’s premiums remitted toward meeting health care expenses.

Additionally, between public sector general insurers it has been proposed that there should be a merger so as to streamline operations in this industry thus increasing efficiency.

All details are described within such memo, refer back to this letter.

This followed submission by Nagpur Divisional Life Insurance Corporation Employees Union who had taken their grievances before Union Minister while seeking redress. The appeal presented issues arising from business within the sector of assurance.