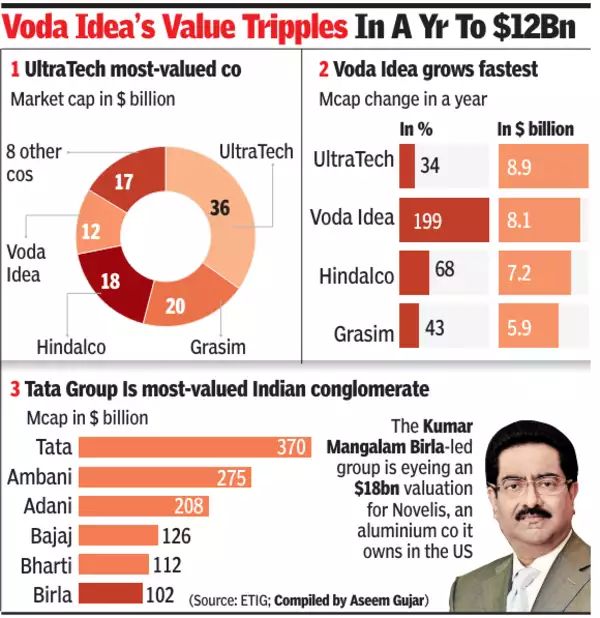

Mumbai: Analysis of Aditya Birla Group’s Market Value On Friday the company’s market value crossed $100bn for the first time after SuperTek, Hindalko and Vodafone Idea shares went up.

The combined value of these group firms is nearly INR 85,000 Crore which is over $102 billion. This year alone, the group’s market cap has risen by 11%, more than double that of Nifty or sensex.

Nevertheless UltraTech Cement contributes almost 35% to the conglomerate’s valuation despite being one among twelve companies listed on stock exchange with a market capitalisation of Rs 295 billion in making it third most expensive cement maker in world. Following an increase in its net profit by 35% percent in Q3 this year, UltraTech share price has been rising.

grasim industriesAccounting for one fifth of the group’s equity market capitalization increase over the last three years. It commands significant portion of global synthetic fiber markets. Also Company has announced capacity expansion and diversification into coatings business. Grasim also owns UltraTech and Aditya Birla Capital, responsible for handling all financial services businesses done by the conglomerate.

In terms of percentage increase, Vodafone Idea posted highest gains whose market cap rose almost three times over twelve months. They included stock expansion due to additional public offer worth INR180billion rupees. The listed financial service firms under Aditya Birla Capital Limited including; Aditya Birla Money Limited ,Aditya Birla Sun Life Asset Management contribute approximately 9% to total group value.