Citigroup Chief Executive Jane Fraser said Monday that consumer behavior has diverged as inflation on goods and services makes life more difficult for many Americans.

Frazier, who leads one of the largest credit card issuers in the United States, said she sees “the K-shaped consumer.” That means the rich continue to spend while lower-income Americans become more cautious about spending.

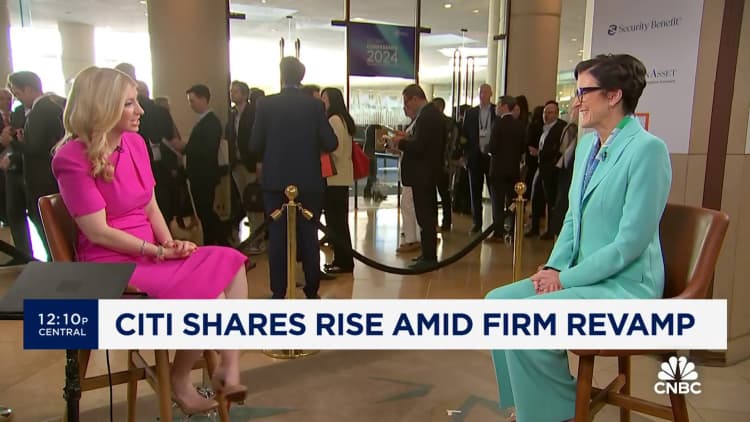

“Wealthy clients have been a big part of the growth in spending over the past few quarters,” Fraser told CNBC. Sarah Eisen in an interview.

“We’re seeing lower-income consumers being more cautious,” Fraser said. “They are feeling more pressure on the cost of living, which has been high and increasing. So while they have employment opportunities, their debt service levels are higher than before.”

The stock market this year hinges on one question: When will the Federal Reserve begin to relieve What will happen to interest rates after 11 consecutive rate hikes?Strong jobs data and persistent inflation in some categories complicate the picture, hampering economic growth expect When will the easing policy begin? That means Americans must endure higher interest rates on credit card debt, car loans and mortgages for a long time.

“I think, like everyone here, we would like to see economic conditions that allow rates to come down as quickly as possible,” Fraser said.

“A soft landing is hard to come by,” the CEO added, using the term high interest rates can lower inflation without triggering a recession. “We’re hopeful, but it’s always hard to achieve.”